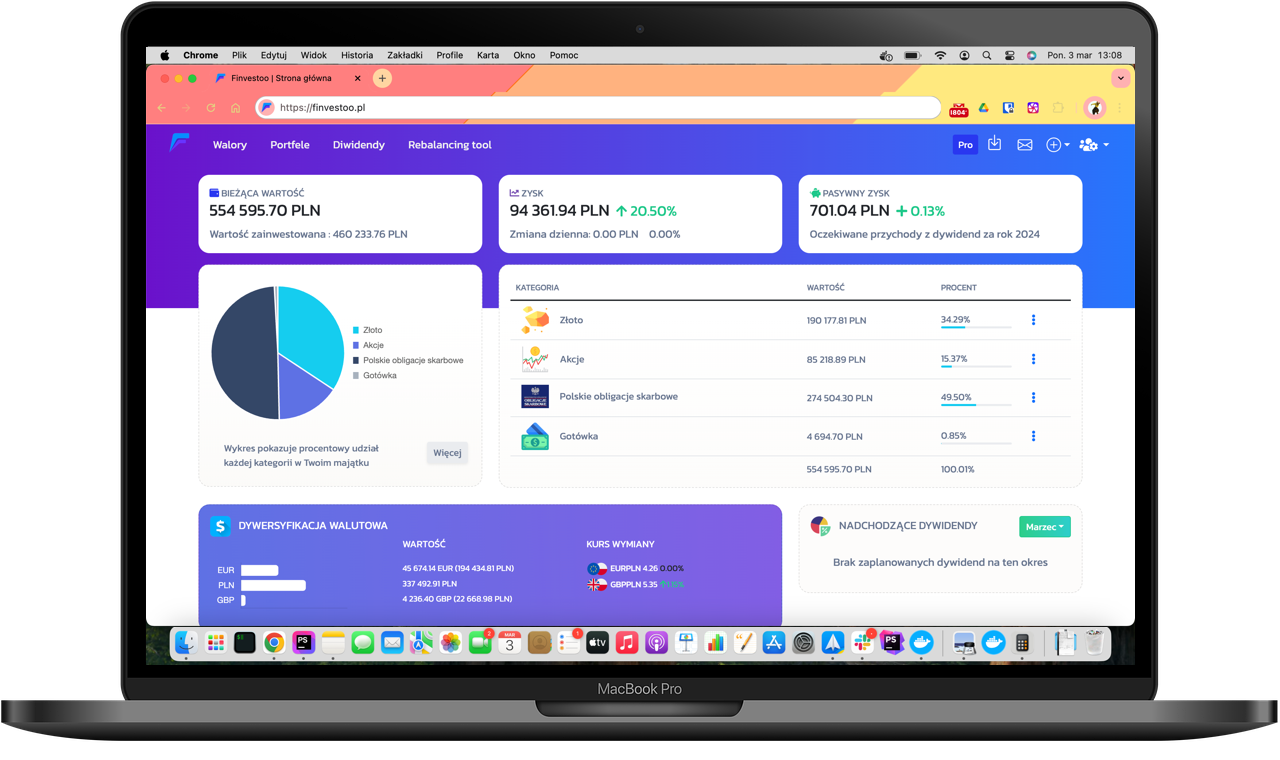

Finvesti is a portfolio management application designed for investors who want full control over their capital — without spreadsheets, manual calculations or scattered data across multiple accounts. It's an intuitive, powerful investment app that helps you track, analyze, and improve your long-term results.

Whether you invest through brokerage accounts, IKE/IKZE, ETFs, bonds, foreign markets, or manage investments together with your spouse — Finvesti brings everything into one clean dashboard.

Because most individual investors face the same problem:

• Investments are scattered across multiple platforms,

• it's difficult to stick to a portfolio strategy,

• rebalancing requires calculating, comparing, and maintaining proportions,

• manual spreadsheets quickly become outdated,

• monitoring investment performance across multiple accounts is tedious.

Finvesti solves this problem with a single tool.

Join testersThe app automatically counts and converts all your investments – no matter where you keep them. We provide:

• total portfolio value,

• division into asset classes (ETFs, stocks, bonds, gold, etc.),

• currency exposure,

• results and deviations from the strategy

Add transactions manually or upload broker statements (CSV). The app intelligently assigns tickers, exchanges and instrument categories — so your investment tracking becomes effortless.

Create your own allocation model, for example:

• 55% government bonds

• 30% stocks

• 15% gold

Or use ready-made models based on known investment strategies.

Control your results and stick to your rules.

Finvesti includes a dedicated tool for rebalancing your portfolio — automatically suggesting how to adjust your positions. Also points:

• How to allocate a new deposit to return to the strategy,

• What and how much to buy/sell to achieve the right proportions,

• Which assets are 'overheated',

• Which assets are 'undervalued'

This way you don't have to count anything yourself.

For anyone who wants to control their money and enjoys numbers, analysis, and tools. Perfect for:

Own IKE, IKZE, brokerage accounts, invest in ETFs,

Value the F.I.R.E. approach

(financial independence and early retirement)

How Finvesti helps:

✓ Data consolidation, portfolio analysis, rebalancing

Have 2× IKE/IKZE, planning retirement together

Together they manage the financial safety cushion and other portfolios related to family's needs

How Finvesti helps:

✓ "Family portfolio" view, joint contribution planning

✓ Full control over investments

Systematically contribute to IKE/IKZE but lack tracking tools

How Finvesti helps:

✓ Track strategy execution, allocation and results

Have accounts with foreign brokers (e.g., IBKR, Degiro)

How Finvesti helps:

✓ Automatic currency conversion, integration, unified portfolio view

Because we know real investing happens outside spreadsheets. Finvesti helps you: .

It's a simple, intuitive and powerful tool for everyone who wants to manage investments consciously and confidently.

„W końcu aplikacja, która agreguje wszystkie moje konta inwestycyjne w jednym miejscu. Finvesti to przejrzysty tracker portfela z funkcjami, których zawsze brakowało w innych aplikacjach. Sprawny helpdesk”

„Mam kilka kont inwestycyjnych:

- IKE, IKZE swoje i żony,

- Obligacje skarbowe

Logowanie się na 3-4 różne konta jest zawsze bardzo irytujące.

Wreszcie mam prosty w użyciu portfel inwestycyjny, który pokazuje je wszystkie naraz”

„Ta aplikacja to złoto! Zaimportowałam historię z ike i ikze, wszystkie ceny są na bieżąco. Widzę całość swoich inwestycji.”

„Kontakt z autorami aplikacji jest błyskawiczny — zgłosiłem brak tickera i został dodany tego samego dnia.

Czuć, że Finvesti tworzą inwestorzy, a nie instytucja bankowa.

Czekam na apke na telefon”

„Z rebalancingiem zawsze walczyłem sam — liczenie w Excelu było męczarnią. Finvesti robi to za mnie w sekundę i pokazuje dokładnie, co kupić i sprzedać. Polecam!”

Start out small and upgrade as you grow. No surprises, no hassle.

Save up to 18% with yearly plan

Free for ever

Get to know Finvesti on your own terms

Benefits included:

12.3PLN per month

Save 16% with yearly plan

Benefits included:

25.0PLN per month

Save 18% with yearly plan

Benefits included:

Free for ever

Get to know Finvesti on your own terms

Benefits included:

10.3PLN

billed yearly 123.0 PLN

per month

View monthly billing

Benefits included:

20.5PLN

billed yearly 246.0 PLN

per month

View monthly billing

Benefits included: